Inflation Reduction Act

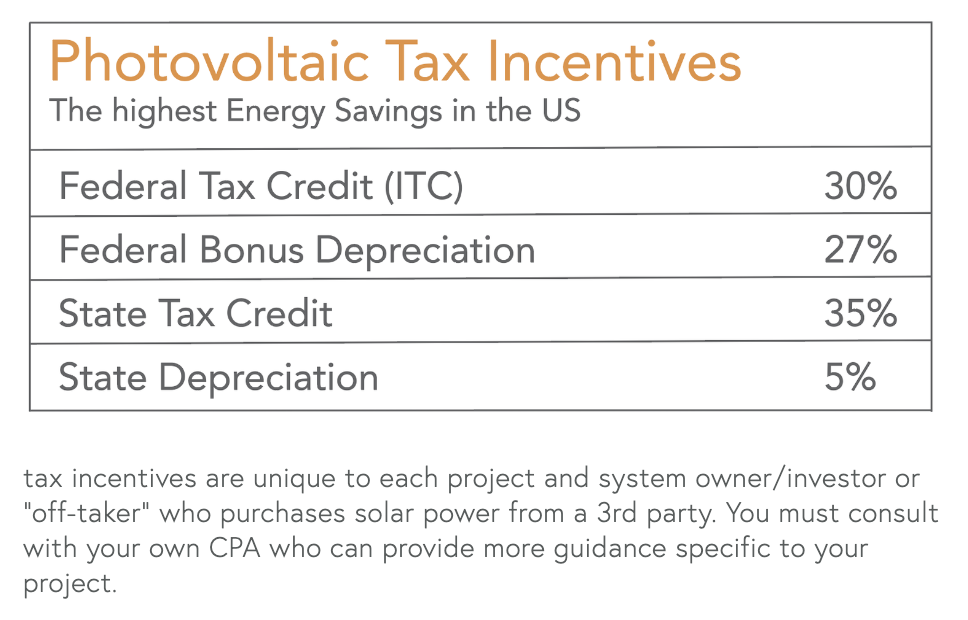

The Inflation Reduction Act (IRA) passed in 2022 and has improved Federal tax incentives for photovoltaic systems and other callouts in the IRA make the economics of solar in Hawaii better than ever. Tax incentives combined with the savings in the first year can cover close to the entire upfront cost.

- Additional Federal Tax Credit incentives pending final guidance from the US Treasury

- 10% Adder for Domestic Content

- 10% Adder for Energy Communities – areas near shutdown coal plant such as Kapolei is one example of an energy community

- 10% for Low Income community projects

- Refundable ITC for Tax Exempt Entities

- Direct Transfer of the ITC

The IRA is scheduled to remain in effect until 2032. It is driving up demand and potentially costs so there are advantages to acting now. Clarification on these rules will be published by the Treasury soon. We will help you pursue and qualify for the maximum tax benefits on your project.