We are frequently asked, “is now still a good time to go solar?” Our response is, and has always been, “the best time to go solar was yesterday, the second best time is today!”

That statement has always been true and this year it’s proving more relevant than ever. The fact is, we’ve never had a client say “I should’ve waited.” Instead, they always say, “I wish we’d installed solar sooner!” This year, due to shifts in the material market, solar incentives, and production issues, that statement couldn’t be more true.

1. Demand for Materials

Current demand for materials could potentially affect the price of going solar in the future. Rare earth minerals that produce elements like lithium and cobalt are starting to see price increases. Driven by an increased demand for producing batteries for the booming Electric Vehicle market, these rare minerals are the same materials used in residential solar battery systems.

A recent study by the International Energy Agency, indicated that “lithium, used in EV batteries, is expected to grow 70x in the next few decades.” However, this study isn’t taking into consideration the growing demand for residential solar + storage. They also point out a major supply chain constraint noting that “in 2019, 70% of world’s cobalt production came from the Demorcatic Republic of Congo.” That’s just one country producing nearly 3/4 of the world’s supply of this precious and necessary material, which leads to a very high possibility of price fluctuations.

2. Solar Incentives

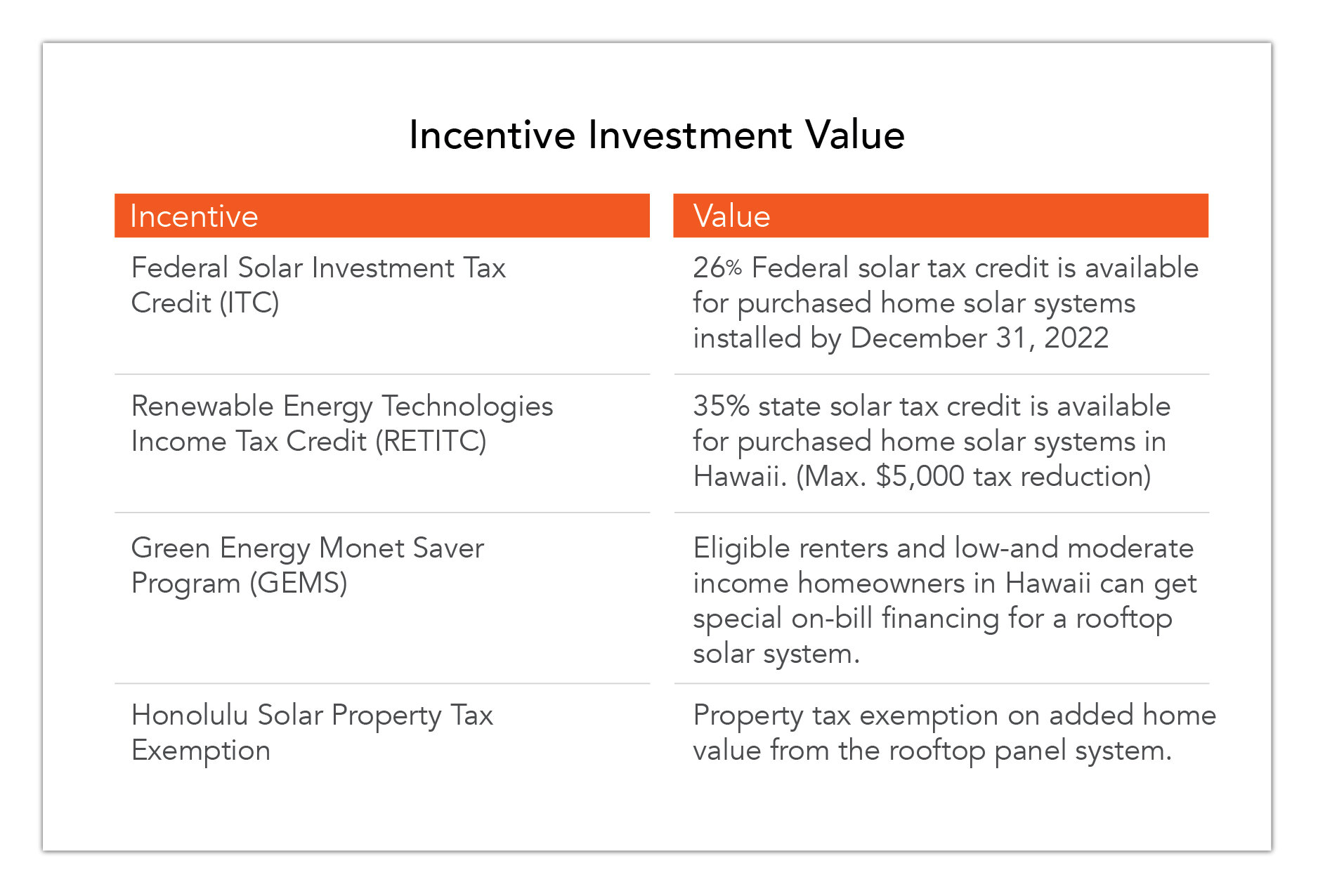

We often hear misinformation regarding Solar Incentives. There have been numerous stories about the “fate of solar tax credits,” and if you haven’t been following the tax credit conversation closely, it’s hard to know what’s available.

Here is where it stands now: The 26% federal solar tax credit is available for residential solar systems installed by December 31, 2022. In 2023, the tax credit will step down to 22%. In 2024, the tax credit for residential solar ends. Act today for big tax incentives!

In addition to the federal ITC there are also state tax credits, financial assistance programs and tax exemptions that you may be able to take advantage of.

3. The “Chip” Shortage

No, not the yummy ‘kine you pick up at the grocery store….thankfully. We are talking about “micro chips,” also known as semiconductors. These are found in just about everything you use in your day-to-day life including gaming consoles, smartphones, air conditioning units, electric vehicles, and you guessed it… solar products. While prices are currently stable, a combination of increased demand and production delays are causing a shortage which will affect prices as we head into the 4th quarter.

Considering all of these factors, we stand by our saying that “the best time to go solar was yesterday!” And while you can’t go back in time, you can click on the link below or call us at 808.748.8888 TODAY to get started!